Duties of the county treasurer include, but are not limited to:

- balancing, proving, and reconciling financial records every month

- receiving innkeepers tax

- collecting property taxes and settling those collections on a semi-annual basis.

NOTE: If your property is up for Tax Sale, making payment online WILL NOT remove it from the sale. You need to come into the office and bring cash or certified funds. If you have any questions please call the office. Thank You.

Property taxes in Cass County will be due, Spring May 12, 2025, and Fall on November 10, 2025. Payments may be made in person at the Treasurer's Office located in the Courthouse at 200 Court Park Room 104, Logansport, In 46947. A drop box drive-up area is located on the southeast corner of the courthouse for payments. PAYMENTS PUT IN DROP BOX AFTER 4:00 PM, MAY 12TH & NOV 10TH, WILL BE CONSIDERED LATE. PENALTIES WILL BE APPLIED. We ask that NO cash be put in the drop box. If you want a receipt, please add a self-addressed stamped envelope, this goes, for if you mail it in also. If you did not get your bill you can still pay without it.

How To Pay Your Bill

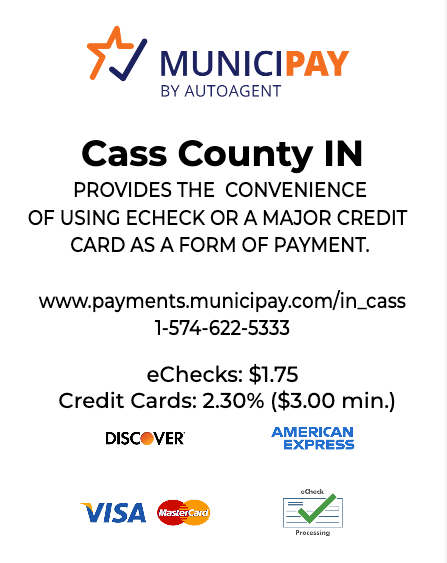

VIRTUAL PAYMENT

If payments are mailed, they should be sent to Cass County Treasurer, 200 Court Park Room 104, Logansport, IN 46947. Spring payments must be postmarked by May 12, 2025. Fall payments must be postmarked by November 10, 2025. If you are mailing your payment on the last day we strongly suggest that you take the envelope inside the post office and have it hand cancelled. Payments received with a postmark after due dates are subject to penalties. (Meter dates are not acceptable)

Included in the property tax bill mailing is the Tax Summary 1 (TS1) which has "SPECIAL MESSAGE TO PROPERTY OWNER" printed on the top. This form provides information on the property's assessed value, exemptions, ditches, and detailed tax rates as well as percentages of increase or decrease in taxes.

It is not necessary to file each year for the Homestead Credit. If you have a Homestead Credit but are not entitled to the deduction, you must contact the Cass County Auditor's Office or face further penalties. Taxpayers are entitled to only one Homestead Credit in the State of Indiana. Taxpayers may check their TS 1 form under Table 5 to verify they are receiving the Homestead Credit. Questions on the Homestead and other deductions can be directed to the Cass County Auditor's Office at (574) 753-7720.

Tax information is available at casscounty09.com. Taxpayers can view real property, personal property, and mobile home property tax information, real property record cards, and other pertinent information.

-

- When will I receive a statement for my property taxes?

Once the county receives tax rates and the abstract of property taxes is completed, the process of printing and mailing tax bills will begin.

- When is the next due date?

The due dates will be determined when the abstract of taxes is completed.

- May I pay on my taxes even though a due date has not been determined?

Yes, the property owner is welcome to pay any amount, at any time. Payments will be reflected on the bill, once the bill is calculated.

- Do I have to pay my taxes if I don't receive a statement in the mail?

Failure to receive a tax by mail does not relieve the taxpayer of the responsibility for payment, and penalties when delinquent.

- If I pay my taxes after the due date, what happens?

A penalty will be imposed. This penalty may be 5% or 10% of the unpaid balance.

- What happens if my check bounces?

RETURNED CHECKS - A fee of $25.00 will be charged for each returned check not honored by the bank and your tax payment will be voided.

- Do you take credit or debit cards?

Electronic payments can be made at https://www.velocitypayment.com/ebills/billLookup/casscounty#/viewBills. Electronic payment options are credit and debit cards. A convenience fee (varies by the type of payment made) will be added to the tax total. Cass County receives NO portion of this fee. The website is 100% secure and confidential. We DO process electronic payments in the office.

- Why do you have record of my bankruptcy filing?

The Cass County Treasurer is required to adhere to bankruptcy rules and regulations; therefore it is necessary to receive this information.

- Other Questions? Find out who to Contact...

- Taxes, Payments - Treasurer's office (574) 753-7850

- Deductions, Property Ownership - Auditor's office (574) 753-7720

- Assessments, Personal Property - Assessor's office (574) 753-7710

- Look up property Tax Info?