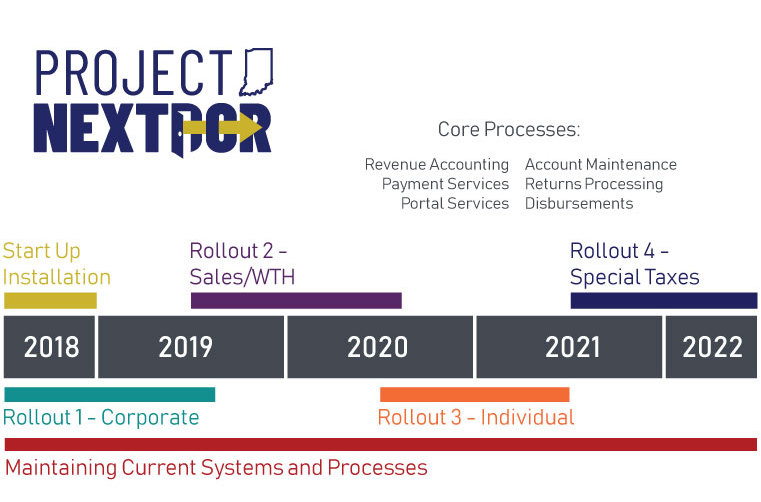

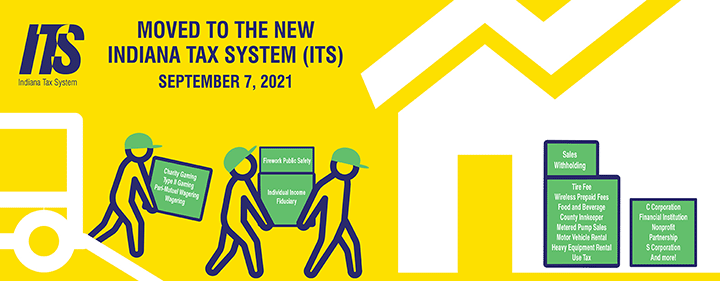

With the support of Governor Holcomb and the Indiana General Assembly, the transformation of DOR’s tax systems and service delivery began in 2017 and has been the agency’s focus for the last five years. The Indiana Tax System (ITS) was officially introduced in September 2019 along with DOR’s new e-services portal, the Indiana Taxpayer Information Management Engine (INTIME), which enables Hoosiers to manage their taxes in one convenient location, 24/7. Through a series of carefully planned rollouts, the new tax system and portal replaced the agency’s legacy tax systems that had been in production for more than 25 years.

Information on previous rollouts can be found at the bottom of this page.

Rollout 4

Project NextDOR's Rollout 4 focuses on moving the following special taxes from the legacy system to the new Indiana Tax System (ITS) on July 18, 2022:

- Alternative Fuel (AFD)

- Aviation Fuel Excise (AVF)

- Fuel Inventory (IVT)

- Gasoline Use (GUT)

- Motor Fuel (MFT)

- Petroleum Severance License (PST)

- Special Fuel (SFT)

- Terminal Operator License (TOL)

- Transporter License (TRP)

- Alcohol Tax (ALC)

- Cigarette (CT)

- Other Tobacco Products (OTP) - Includes E-Cigarette

- Employment Agency License

- Rail, Commuter or Electric

- Vehicle Sharing Excise (VSE)

Now that Rollout 4 is complete, these taxes have moved to ITS. Each tax type has new and existing functionalities within INTIME:

- New Electronic Cigarette Tax

New Indiana state legislation (Indiana Code 6-7-4) was passed in early 2021, imposing an Electronic Cigarette Tax to be collected by retailers on the sale of open system containers and vapor products. Information Bulletin #206 regarding the new Electronic Cigarette Tax was updated (June 2022).

This state legislation requires retailers to apply for an Electronic Cigarette Retail Dealer’s Certificate with the Indiana Department of Revenue (DOR). As of June 7, 2022, retailers can submit an application for the Electronic Cigarette Tax (ECG-1A) license via INTIME. Alternatively, an application form is also available.

Important items to note:

- Applying for the ECG-1A certificate can be done with or without logging in to INTIME. An INTIME User Guide for Electronic Cigarette Tax Registration is available to help with the process.

- Registration for the ECG-1A certificate opened June 7, 2022, and the deadline to apply was July 1, 2022, for businesses currently selling these products.

- To register, applicants need their Federal ID Number (FEIN), Indiana Tax Identification Number (TID), and/or owner’s Social Security Number (SSN).

- To obtain an Electronic Cigarette Retail Dealer’s Certificate, a bond in the amount of $1000 and a $25 payment are required.

- Upon approval, an e-cigarette (ECG) tax account will be automatically added to the retailer/business/corporate INTIME account on July 18, 2022. (Note: If not signed up for an INTIME account, an INTIME Guide for Business Customers is available to help with the process.)

- Beginning July 18, 2022, ECG-1A certificates will be mailed via U.S. Postal Service to the physical address provided during registration.

- Returns and payments are due the 15th day of each month.

To begin the application process, go to INTIME and locate the “Registration” panel, select “New tax registration”, then go to the “Tobacco registration” panel (will appear beginning June 7, 2022), and click on the “Register an electronic cigarette account” hyperlink. The application can also be completed while logged in to INTIME from the “All Actions” page (tab). An INTIME User Guide for Electronic Cigarette Tax Registration is available to help customers through the process.

- Alcohol, Cigarette, and Other Tobacco Products Tax Customers

Business customers were first introduced to INTIME in 2020 to manage sales and withholding tax accounts. As of July 18, 2022, customers who file Alcohol (ALC), Cigarette (CIG/CTS), and Other Tobacco Products (OTP) taxes can use INTIME to manage their tax accounts as well.

What this means for customers beginning in July 2022:

- INtax no longer supports Alcohol and Other Tobacco Products tax filing as of Friday, July 8, 2022.

- As of July 18, 2022, customers can use INTIME to file and pay tax obligations, as well as submit cigarette stamp orders.

- Alcohol, Cigarette and Other Tobacco Products tax accounts have been added automatically to INTIME and are viewable on the “Summary” page (tab) as of July 18, 2022.

- Monthly return due dates remain the same.

- Customers are be able to submit returns and schedules by securely uploading XML files (up to 10 MB) in INTIME without the need for additional encryption.

- XML file uploads larger than 10MB in size should continue to be submitted via SFTP (Secure File Transfer Protocol) bulk upload filing.

- Customers are be able to use INTIME to view tax accounts, file returns, amend returns, make payments, and view and respond to correspondence from DOR.

- An instructional guide to get started with INTIME is available for ALC, CIG, and OTP customers.

SFTP Bulk Upload Filers:

- XML file submissions of up to 10MB can be uploaded directly through INTIME.

- XML file uploads exceeding 10MB should continue to be submitted via SFTP bulk upload filing.

- All payments can be made via INTIME.

- More information on SFTP bulk upload filing is available for Alcohol and Cigarette and Other Tobacco Product taxpayers.

- Customers who do not yet have INTIME access can sign up for access with a welcome letter. Instructions on signing up for INTIME access are available in the INTIME User Guide for Business Customers. More information and INTIME instructional guides for affected customers are available to help with the process.

- Fuel Tax Customers

As of July 18, 2022, customers who file Fuel taxes can be able to use INTIME to manage their accounts. What this means for Fuel tax customers:

- INtax no longer supports Fuel tax return filing as of Friday, July 8, 2022.

- As of July 11, 2022, Access Indiana stopped accepting Electronic Data Interchange (EDI) files (Motor Fuel, Special Fuel, Transporter, Terminal Operator Report) from Fuel tax customers.

- As of July 18, 2022, customers can use INTIME to file and pay tax obligations.

- Fuel tax customers who file paper returns (Petroleum Severance and all amended returns) can file and pay electronically via INTIME as of July 18, 2022.

- All Fuel tax accounts have been added automatically to INTIME and are viewable on the “Summary” page (tab) as of July 18, 2022.

- Fuel tax customers have the option to file returns by manually keying information or by uploading files up to 10 MB in size via INTIME.

INTIME does not require EDI filers to register with DOR as was previously the case, which means:

- Any Fuel tax customer can upload an EDI file from the “All Actions” (tab) page.

- Any EDI files uploaded on INTIME will be treated as returns.

- Fuel tax customers are no longer required to submit “test files.” However, “test files” are accepted via email for new customers or in special circumstances as deemed necessary. Contact DOR via Bulkfiler@dor.in.gov if submitting a “test file.” All other files will be processed as production files via INTIME.

An instructional guide on getting started with INTIME is available for Fuel Tax customers.

SFTP Bulk Upload Filers (Gasoline Use Tax Only):

- XML file submissions of up to 10 MB can be uploaded directly through INTIME or can continue to be submitted via SFTP bulk upload filing.

- XML file uploads exceeding 10 MB will continue to be submitted via SFTP bulk upload filing.

- All payments can be made via INTIME.

- More information on SFTP bulk upload filing is available.

Customers who do not yet have INTIME access can sign up for access with a welcome letter. Instructions on signing up for INTIME access is available in the INTIME User Guide for Business Customers. More information and INTIME instructional guides for affected customers are available to help with the process.

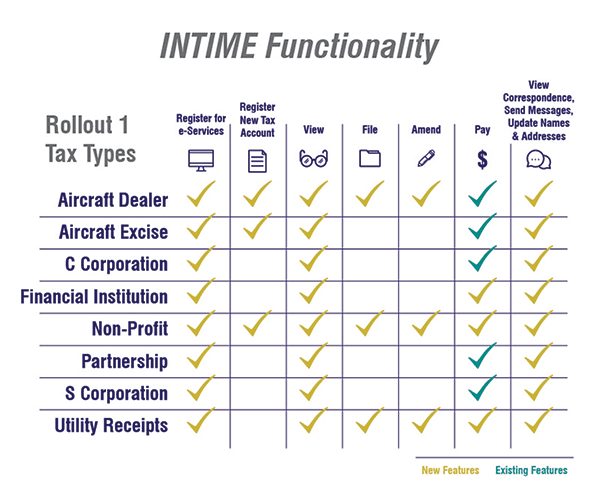

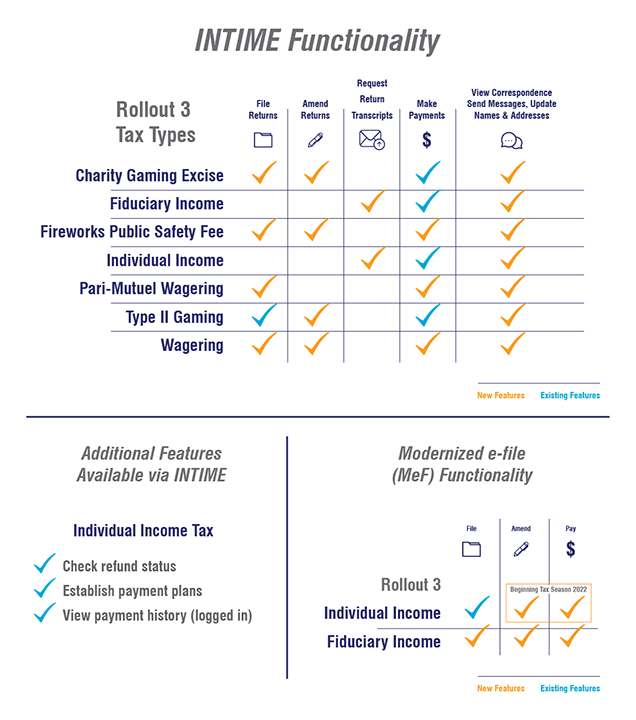

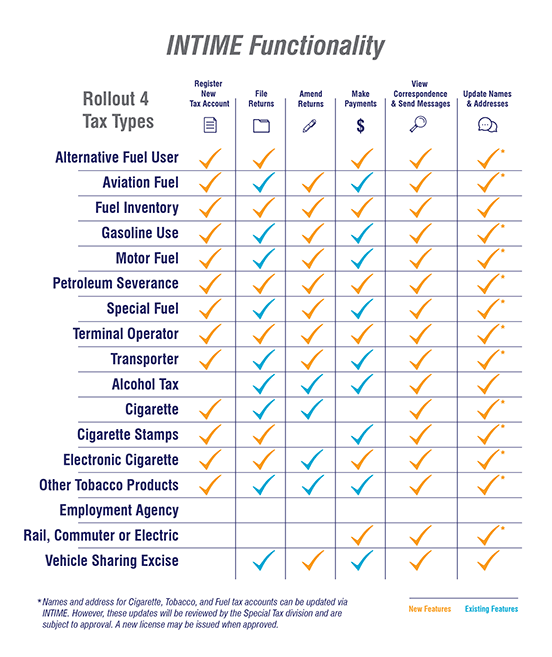

See a complete INTIME Functionality Chart listed by tax type.

INTIME Resources

- INTIME User Guide for Business Customers

- INTIME User Guide for Individual Income Tax Customers

- INTIME User Guide for CGE and TTG Customers

- INTIME User Guide for Electronic Cigarette Tax Registration

- INTIME User Guide for Alcohol, Cigarette, and Other Tobacco Products Tax Customers

- INTIME User Guide for Fuel Tax Customers

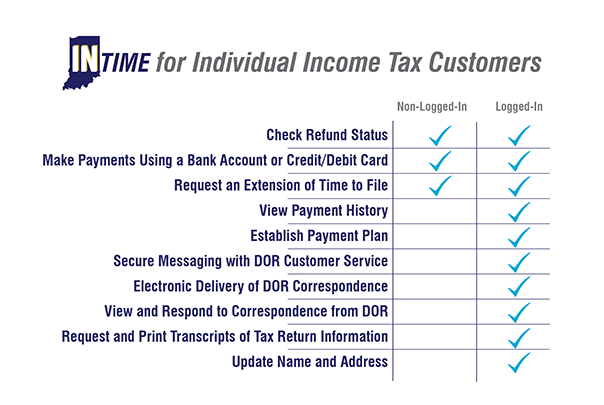

Individual Income Tax Customers

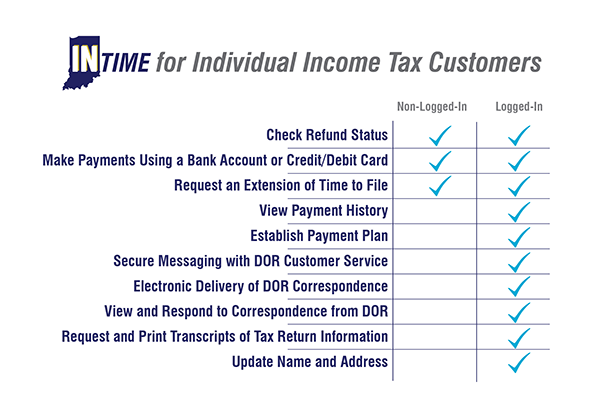

As of September 2021, Individual Income tax customers can create a username and password for their new INTIME account to access features that include: