By MoneyWise Staff

Wednesday, December 18, 2019

Most people don’t get a pay stub delivered to them along with the paycheck anymore, because most employers issue a direct deposit check and the funds just appear in your bank account. This doesn’t mean that pay stubs no longer exist, or that pay stubs are no longer important. Reviewing your pay stub can help you spot errors and be aware of where the money that isn’t deposited into your account is going. There is good information about your finances located on this slip, knowing about your withholdings, taxes, benefits and retirement contributions can help you be better off financially. In this post, I’ll show you how to locate your pay stub (for state of Indiana employees), and define some of the information you see on your pay stub. If you are not a state of Indiana employee, check with your Human Resources Department.

funds just appear in your bank account. This doesn’t mean that pay stubs no longer exist, or that pay stubs are no longer important. Reviewing your pay stub can help you spot errors and be aware of where the money that isn’t deposited into your account is going. There is good information about your finances located on this slip, knowing about your withholdings, taxes, benefits and retirement contributions can help you be better off financially. In this post, I’ll show you how to locate your pay stub (for state of Indiana employees), and define some of the information you see on your pay stub. If you are not a state of Indiana employee, check with your Human Resources Department.

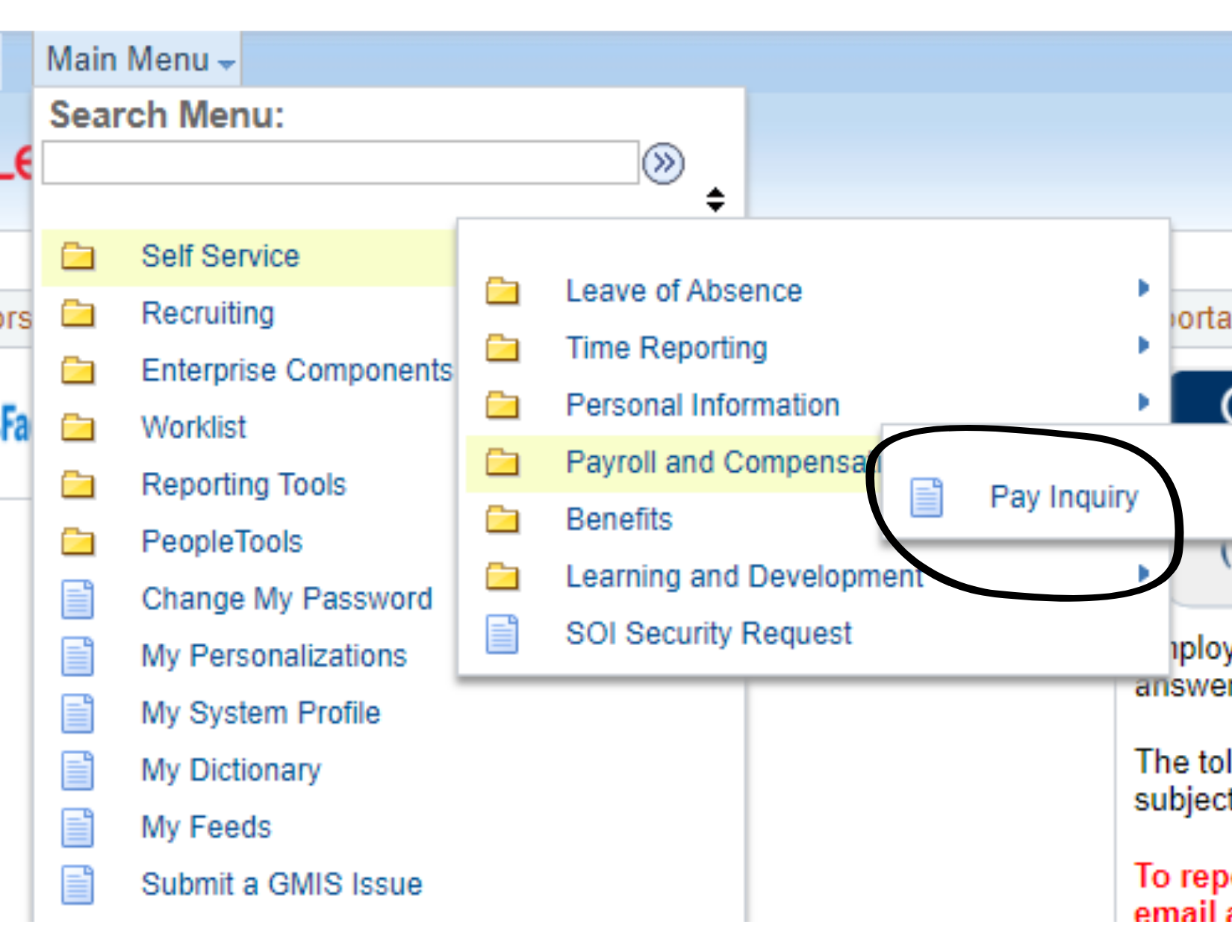

For state of Indiana employees, your pay stub can be found in PeopleSoft. The same place you go to submit your time, except instead of selecting "Time Reporting", you'll go to "Payroll and Compensation". From there, you click on "Pay Inquiry" and this will open a new window with your pay stub.

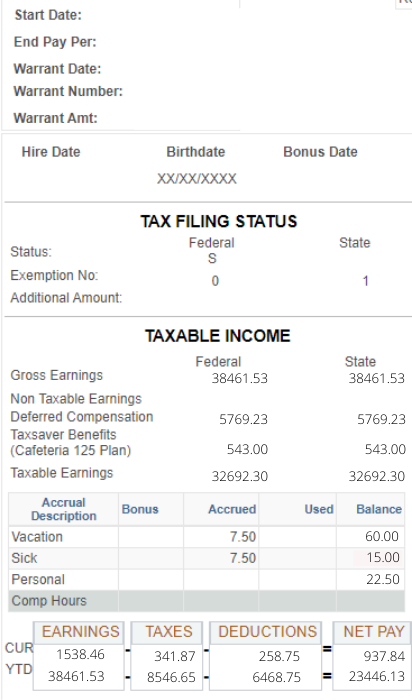

Now that you've found your pay stub, again, if you are not a state of Indiana employee, be sure to ask your HR department, let's look at the earnings and taxes. Below is an example of a pay stub for John Smith, making a $40,000 salary.

For state of Indiana employees, we have information about our employment anniversary (Bonus Date) at the top of our paychecks, this refers to when you will be awarded paid time off. You can find more about this in the State of Indiana Employee Handbook, or your agency's employee handbook. Just below that, is your Tax Filing Status, this correlates to the W-4 tax form that you completed with your HR representative. You can change your exemptions at any time, this will impact your take home pay amount. If you opt for less money withheld for federal taxes, you need to plan ahead for tax filing season, as you might owe money instead of getting a tax return. The IRS has an IRS Withholding Calculator that can help you estimate what you should claim on your W-4.

The majority of your paystub describes income earnings, tax withholdings, retirement contributions and medical premiums. Let's review some common terms.

Pay Period: The dates on your pay stub will inform you of your pay schedule, whether it's weekly, bi-weekly, or monthly. If you're paid weekly you would multiply the pay by 52 to calculate the annual salary. If paid bi-weekly multiply by 26, and if paid monthly, multiply by 12. State of Indiana employees are paid bi-weekly or 26 times a year.

Gross Earnings: This is the total amount earned for the pay period, including wages/salary, plus bonuses and tips if applicable. For this example, the pay stub shows how much John Smith has earned year to date (YTD), after 25 out of 26 pay periods.

Non Taxable Earnings: The IRS definition of a non-taxable wage is fairly narrow, but an example of such is disability wages and worker's compensation.

Deferred Compensation: This part of your income is set aside to be paid to you at a later time, also known as invested retirement funds. You don't pay taxes on this portion of income until the money is paid out.

TaxSaver Benefits (Cafeteria 125 Plan): This is an employee benefit offered by section 125 of the Internal Revenue Code, allowing for your premiums to be deducted before taxes are applied to your income. This allows for your take home pay to be a little bit bigger.

Taxable Earnings: This portion of your income, is used to figure the taxes you'll pay to Federal, State and Local entities as well as your premium for Medicare/FICA. You can learn more about tax and premium calculations in the next post, The Anatomy of Your Paycheck Part Two, where I break down the other half of your paycheck.

Some pay stubs summarize your paid time off. Like you can see on John Smith's pay stub, state of Indiana employee pay stubs reflect overall taxes, deductions and take-home income for the pay period and YTD.

Net Pay: This is your take-home pay. Calculated after all taxes, insurance premiums, deferred compensation/retirement contributions and deductions have been subtracted out, this is the remainder of your income.

If you're like most people, the number on your pay stub that really matters is the cash dollar amount on your paycheck. We are all excited to get paid and have money deposited into our accounts. Although, it is important to review your pay stub, being tuned into where every dollar goes will help you take full advantage of your employee benefits. If there is a mistake in your pay or an opportunity to better your retirement or take-home pay, this is where you'll likely notice it. In our next post, we will analyze another part of your pay stub: insurance premiums and retirement accounts. Be sure to check out the Anatomy of Your Paycheck Part Two on January 8, 2020. This will be our first post of the New Year.

Blog topics: Budgeting, Credit, Archive

The MoneyWise Matters blog has a wealth of information about managing money and avoiding fraud. You can look through the complete archive here.