By

Wednesday, December 2, 2020

Here at Indiana MoneyWise, we’re avid followers of the Federal Trade Commission blog and highly recommend you follow it in addition to MoneyWise Matters. This week, while seeking writing inspiration, I stumbled across one of their posts from June, called “What do COVID-19 scams look like in your state?” As an investor education coordinator, I do my best to stay up-to-date on common scams and fraud schemes, and the title of this blog post promised state-specific data! I was intrigued, but also a little intimidated by the wealth of number-specific data.

Side note in the form of a confession: I am terrible at math. Not only that, but I’m afraid of it. Despite having zero psychological training, I have diagnosed myself with mathematical anxiety, which is a real phobia. I go out of my way to avoid having to do any sort of calculations. Even the most basic addition, subtraction, multiplication, or division problems trigger a physical response that can include elevated heart rate, fear, sweating, and sometimes tears. Despite this, I’m fascinated by statistics and data, and I see myself a citizen scientist with an abundance of curiosity.

So what does the data tell us about COVID-19 scams in Indiana? Quite a lot, actually. But first, a short explanation of the FTC’s state-specific data on COVID-19-related issues. It’s based on complaints the FTC receives from consumers related to COVID-19, with reports about online shopping problems topping the list of complaints in most states. Under its expanded reporting, the FTC created a data dashboard that lets you click on your state to see what people near you have been reporting, and you can see how people across the country are being affected, too. The dashboard was announced back in June, but it is regularly updated.

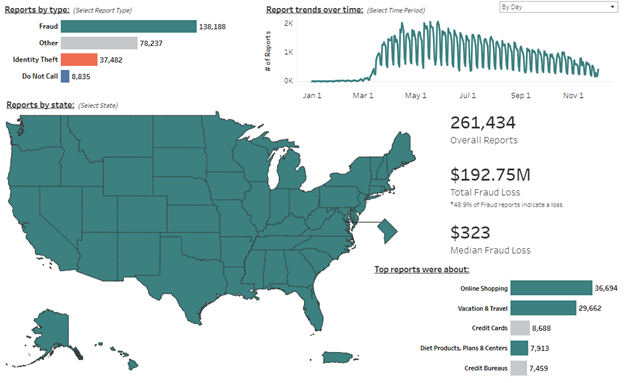

Here’s a quick look at the most recent numbers. This data was last updated on November 30, and it reflects overall reports since January 1, 2020.

The FTC points out that the data reflects reports in the Consumer Sentinel Network that mention COVID, stimulus, N95 and related terms. Everything on this map (the real one, not the screen grab I posted above) is interactive. You can view more information about the reports by type, trends over time, state-specific reports, or top reports by subject, such as online shopping or vacation and travel.

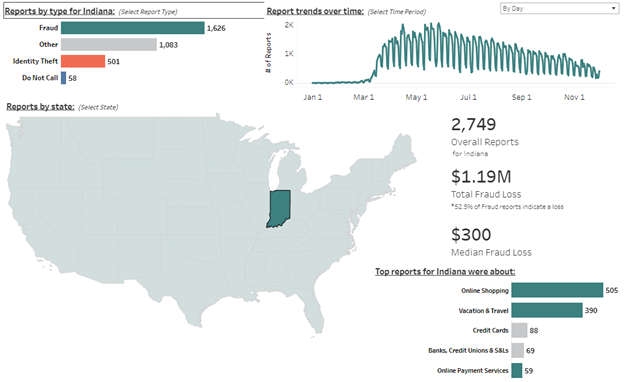

Now let’s look at the Indiana-specific data.

Our numbers are consistent with reports in other states. Top reports relate to online shopping and vacation & travel. Though when you move further down the list of top reports, there are some differences. At a national level, reports include problems with diet products, plans, and centers as well as credit bureaus. In Indiana, reports include problems with banks, credit unions, and savings and loans centers as well as online payment services. Median fraud loss at a national level is $323, while median fraud loss in Indiana is $300.

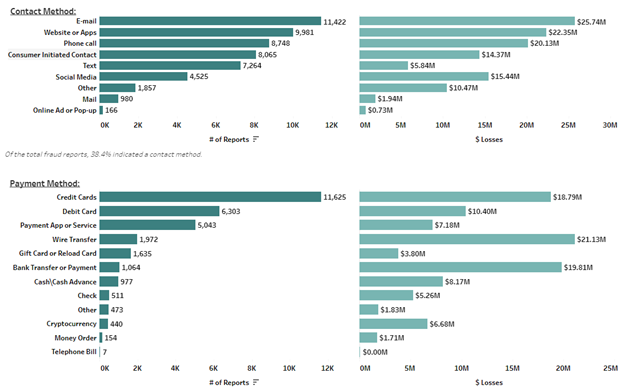

Returning to national numbers when it comes to how consumers were contacted and the payment methods used, we can see that e-mail and credit cards dominate in the number of reports. This graph also look at the amount of money lost in each category.

So what does all this data tell us? Well, there are a lot of people out there getting ripped off, and there’s no shortage of scams and fraud schemes looking to take advantage of our fear and confusion when it comes to the Coronavirus. With virus cases on the rise once again, and expected to continue to trend upward this winter, well all must take caution against getting sick but also against losing money.

To protect yourself and your loved ones from the virus, continue to follow guidance from health officials. Here’s a link to the Centers for Disease Control and Prevention website with the latest information on COVID-19, and here’s a link to Indiana-specific information on COVID-19.

To protect yourself and your loved ones from scams and fraud schemes related to COVID-19, follow this guidance from the FTC.

- Learn how to tell the difference between a real contact tracer and a scammer. Legitimate tracers need health information, not money or personal financial information.

- Don’t respond to texts, e-mails or calls about checks from the government. Here’s what you need to know.

- Ignore offers for vaccinations and miracle treatments or cures. Scammers are selling products to treat or prevent COVID-19 without proof that they work.

- Be wary of ads for test kits. Most test kits being advertised have not been approved by the FDA, and aren’t necessarily accurate.

- Hang up on robocalls. Scammers are using illegal robocalls to pitch everything from low-priced health insurance to work-at-home schemes.

- Watch for emails claiming to be from the CDC or WHO. Use sites like coronavirus.gov and usa.gov/coronavirus to get the latest information. And don’t click on links from sources you don’t know.

- Do your homework when it comes to donations. Never donate in cash, by gift card, or by wiring money.

There’s a lot of information out there, and I know it can be confusing knowing who to trust. Stick to well-known, credible outlets. Also be aware that guidance can sometimes change based on new information. As scientists learn more about COVID-19, their advice on how to avoid the virus will be updated. If we all follow the latest alerts and guidance, we will get through this together.

Blog topics: Fraud Prevention, Archive

The MoneyWise Matters blog has a wealth of information about managing money and avoiding fraud. You can look through the complete archive here.