Search for Keywords

- A

Affordable Care Act - Penalties, Fines or Tax

Athletic Officials

Independent Contractor or Employee

Audits

Coordination and Administration of Audits by Private Examiners

Auditing Services and Contract Requirements

AFFORDABLE CARE ACT PENALTIES, FINES, OR TAX

The State Board of Accounts has received many questions regarding our audit position with regards to the Affordable Care Act. Most of the questions have inquired specifically about the penalties, fines, or tax associated with this law. While our general audit guidelines prohibit the paying of penalties and interest and states that those payments would be a personal charge to the fiscal officer, administrator, or board, we do not believe this general guideline should apply to this controversial, mandated, and complicated law.

We also believe that the governing boards should be making the fiscal decisions associated with their unit of government and the implementation of this law. Therefore, if the fiscally wise decision of the board is to pay the penalties, fines, or tax instead of the cost of the insurance then we will not personally charge the officials involved. One of the conditions necessary to not charging the penalties, fines, or tax is to have the governing board officially document their decision to not comply with the Affordable Care Act. This could be a motion in the board minutes, a resolution, or an ordinance.

In summary, as long as there is an official action of the board to choose to pay the fines, penalties, or tax, the State Board of Accounts will not personally hold anyone in that unit of government accountable for reimbursing the cost of those penalties, fines, or tax.

ATHLETIC OFFICIALS - INDEPENDENT CONTRACTOR OR EMPLOYEE

We often receive inquiries regarding whether an athletic official is an employee of the school corporation or an independent contractor.

The determination whether athletic officials are employees or independent contractors can have important tax, liability, and labor ramifications. Generally, an employer must withhold income taxes, withhold and pay Social Security and Medicare taxes, and pay unemployment tax on wages paid to an employee. An employer does not generally have to withhold or pay any taxes on payments to independent contractors.

IHSAA considers athletic officials to be independent contractors. The IHSAA Officials Handbook states:

"Independent Contractor Status: IHSAA licensed officials are considered independent contractors and not employees of the IHSAA or member schools. As independent contractors, the official is entitled to remunerations for services rendered, but has no entitlements which may be available to an employee of the IHSAA or member schools."

The IRS has not made an official determination of whether athletic officials are employees or independent contractors. However, the IRS has ruled on this issue twice in Revenue Rulings.

In Revenue Ruling 57-119, the IRS held that college sports officials were employees of an athletic association composed of colleges and universities for federal employment tax purposes. The association selected, trained and assigned the officials and also required extensive reporting by the officials.

In Revenue Ruling 67-119, the IRS ruled that a group of high school officials were independent contractors and not employees of their own associations. The association provided training and assigned the officials games, but found that these acts were not enough to make the officials employees of their own association.

The IRS has provided the following guidance for determining if an individual is an independent contractor or employee on their website (http://www.irs.gov/Businesses/Small-Businesses-&-SelfEmployed/Independent-Contractor-Self-Employed-or-Employee):

Common Law Rules

Facts that provide evidence of the degree of control and independence fall into three categories:

1. Behavioral: Does the company control or have the right to control what the worker does and how the worker does his or her job?

2. Financial: Are the business aspects of the worker’s job controlled by the payer? (these include things like how worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

3. Type of Relationship: Are there written contracts or employee type benefits (i.e. pension plan, insurance, vacation pay, etc.)? Will the relationship continue and is the work performed a key aspect of the business?

Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor. There is no “magic” or set number of factors that “makes” the worker an employee or an independent contractor, and no one factor stands alone in making this determination. Also, factors which are relevant in one situation may not be relevant in another.

The keys are to look at the entire relationship, consider the degree or extent of the right to direct and control, and finally, to document each of the factors used in coming up with the determination.

Form SS-8

If, after reviewing the three categories of evidence, it is still unclear whether a worker is an employee or an independent contractor, Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding (PDF) can be filed with the IRS. The form may be filed by either the business or the worker. The IRS will review the facts and circumstances and officially determine the worker’s status.

Be aware that it can take at least six months to get a determination, but a business that continually hires the same types of workers to perform particular services may want to consider filing the Form SS-8.

If you classify an employee as an independent contractor and you have no reasonable basis for doing so, you may be held liable for employment taxes for that worker.

When the athletic official is also employed by the school corporation as a teacher or other employee of the school corporation, this should be disclosed on Form SS-8 and may result in a different determination by the IRS. In instances where an individual provides services in two separate roles to the same business, the IRS examines separately the relationship between the worker and the business for each performance of services. Just as with any examination of worker status, the IRS examines each relationship based on facts that fall into the three categories of evidence explained above—behavioral controls, financial controls, and relationship of the parties. If an employer-employee relationship is found with regard to performance of services for only one role of the worker, remuneration with regard to only those specific services is subject to all FICA and income tax withholding requirements under the Code. If an employer-employee relationship is found for both roles, then remuneration for all services performed by the worker for the business are subject to withholding requirements under the Code.

In conclusion, the determination can be complex and depends on the facts and circumstances of each case. If the IRS rules that a worker was wrongly classified as an independent contractor, there could be significant tax penalties imposed on both the employer and employee. We recommend that either the employer or employee file Form SS-8 in advance with the IRS, which will result in the IRS officially determining the proper worker classification for each circumstance.

The State Board of Accounts will not take exception to the payment of athletic officials using an online payment system with the following conditions:

- The School Board must authorize the use of the online payment system through a resolution, which has been approved in the minutes.

- The School Board must implement and insure that proper internal controls are in place.

- The athletic director shall provide the ECA treasurer with a detailed list of athletic officials that have been scheduled to officiate each contest. A Purchase Order/Accounts Payable Voucher (SA-1) must be completed with a copy of the detailed list attached.

- The ECA treasurer shall transfer the appropriate rate of payment for each official on the detailed list and the estimated transaction fees for the corresponding payments to the trust account.

- After the officials have officiated a contest, the athletic director must validate that the contest was held and services were provided through the online payment system.

- Once the contest has been validated by the athletic director, payments to the officials are initiated by the ECA treasurer through the online payment system.

- The ECA treasurer shall print and retain a report of all payments and transaction fees paid from the trust account. This listing should be attached to the SA-1, supporting the disbursements from the trust account. Any payment without proper documentation may be the responsibility of that officer or employee.

- The trust account must be reconciled by the ECA treasurer on a monthly basis.

- The ECA treasurer is responsible for compliance with all rules, regulations, guidelines, and directives of the Internal Revenue Service and the Indiana Department of Revenue.

- At the end of the school year, all funds remaining in the trust account must be receipted back into the extra-curricular Athletic Fund and deposited into the ECA bank account.

AUDIT COORDINATION AND ADMINISTRATION OF AUDITS PERFORMED BY PRIVATE EXAMINERS

The audits of charter schools may be initiated and administered by the State Board of Accounts; by state or local government funding agencies; or by the entities themselves. Audits may be performed by the State Board of Accounts or private examiners approved by the State Board of Accounts and hired by the charter school.

When the audits are performed by private examiners, coordination of these audits with the State Board of Accounts is required. Per IC 5-11-1-7, private examiners allowed engagements by the State Examiner are subject to the direction of the State Examiner. The following process is required for all audits performed by private examiners.

Request for Proposal

The Charter School creates a Request for Proposal (RFP) for the annual financial, compliance and, if applicable, federal OMB Circular A-133 audit. Request for proposals must contain at least the required wording for contracts and shall be submitted for approval to the State Board of Accounts by email to charterschools@sboa.in.gov by April 15th.

Audit Contract

To obtain approval for a private examiner to audit under IC 5-11, the audit contract must be submitted to the State Board of Accounts, prior to signing. Contracts will not be approved if there is no reference to, or acknowledgement of, the responsibility of the State Board of Accounts in the audit process. For audit periods ending June 30, the audit contract shall be sent to the State Board of Accounts by email to charterschools@sboa.in.gov by September 15th.

Draft Audit Report

Upon completion of the financial audit report and supplemental report on compliance if applicable, the private examiner shall send the reports to the State Board of Accounts by email to charterschools@sboa.in.gov in an unlocked pdf, Microsoft Word, or Microsoft Excel document. A copy of the draft or final Data Collection Form is also required to be sent with the reports when the charter school has contracted for an audit under OMB Circular A-133. The reports will be reviewed and approval returned to the private examiner via email. The reports shall not be issued until reviewed by the State Board of Accounts and approved by the State Examiner.

Exit Conference

When approval is received from the State Board of Accounts, the private examiner shall issue the reports to the charter school. The State Board of Accounts will be notified of the date, time, and place the results of the audit will be discussed with charter school officials (exit conference) at least 2 business days prior to the meeting by email to charterschools@sboa.in.gov.

Final Audit Report

Audits performed by private examiners are to be completed and all required reports issued within 180 days after the close of the audit period.

The private examiner shall send a copy of the financial audit report, the supplemental audit report, as well as any separate communication to the entity's management, such as a management letter, in an unlocked pdf, Microsoft Word, or Microsoft Excel file to the State Board of Accounts through email to charterschools@sboa.in.gov within 10 business days of the report being issued by the private examiner.

Additionally, the private examiner is responsible, after State Board of Accounts approval, to file the report with federal awarding agencies and pass-through entities when an audit is performed in accordance with Government Auditing Standards and/or the Single Audit Act.

Quality Control Review

Due to our oversight responsibility for audits performed in accordance with IC 5-11-1-9, a quality control review of a private examiner's work for sufficiency in scope and adequacy in quality may be performed at the State Examiner's discretion. In addition to a quality control review of the audit, we will evaluate findings of noncompliance for further action required of this department.

Extensions

Any requests for an extension of time must be made by emailing the State Board of Accounts at charterschools@sboa.in.gov. The request shall include the reason an extension is needed and the amount of extra time being requested. Extensions may be granted by the State Board of Accounts for up to an additional 60 days. Requests for extension must be received no later than 30 days prior to the deadlines indicated above to be considered for approval. Extensions are not automatic; any request for an extension may be rejected by the State Board of Accounts. Any extension approval shall be in the form of a written response.

Failure to follow the process outlined above by the charter school or private examiner may result in a comment in the State Board of Accounts transmittal letter, rejection of future audit contracts with the private examiner, or the audit performed by the State Board of Accounts.

Audits performed by private examiners are to be completed and all required reports issued within 180 days after the close of the audit period which is December 27 for those charter schools with a fiscal year end of June 30.

Any requests for an extension of time must be made by emailing the State Board of Accounts at charterschools@sboa.in.gov. The request shall include the reason an extension is needed and the amount of extra time being requested. Extensions may be granted by the State Board of Accounts for up to an additional 60 days. Requests for extension must be received no later than 30 days prior to the report deadline indicated above to be considered for approval. Extensions are not automatic; any request for an extension may be rejected by the State Board of Accounts. Any extension approval shall be in the form of a written email response.

Any charter school that does not have an audit completed and reports submitted by the deadline or request an extension as indicated above may have their audit completed by the State Board of Accounts with all associated costs charged.

Audit frequency of charter schools is subject to requirements set forth by the Department of Education, the charter school's sponsor, the needs of the charter school, and IC 5-11-1-25. In order to comply with U.S. Department of Education requirements for states that administer the federal Public Charter School Program (PCSP) grant, the Indiana Department of Education requires all Indiana charter schools to undergo an independent audit on an annual basis. This annual audit is accepted by the State Board of Accounts as fulfilling the requirements of IC 5-11-1-.25

In addition to the findings required to be included in the financial audit report for compliance with Government Auditing Standards and Uniform Guidance, a supplemental report is required to be issued to identify noncompliance with laws, regulations, and the Accounting and Uniform Compliance Guidelines Manual for Indiana Charter Schools established by the State Board of Accounts found at http://www.in.gov/sboa/4485.htm. This is due to IC 5-1-11-9(d) which states that on every examination performed, inquiry shall be made as to:

- The financial condition and resources of each municipality, office, institution, or entity;

- Whether the laws of the State of Indiana and the Guidelines established under the authority of IC 5-11-1-24 have been complied with; and

- The methods of preparation and accuracy of the accounts and reports of the charter school.

Exhibit A of the Guidelines for the Audits of Charter Schools Performed by Private Examiners (Guidelines) found at http://www.in.gov/sboa/files/guidecharterRevised_2016.pdf identifies the required minimum compliance testing that are in addition to the compliance testing deemed necessary for the risks identified by the auditor during the examination process.

The supplemental report shall also include any response from the school officials concerning the audit and a transmittal letter. This opportunity to respond in written format is established by IC 5-11-5-1. This statute further provides that, if a written response is filed, it shall be submitted by the charter school to the private examiner and become a part of the supplement report. The transmittal letter to be included is found in the Guidelines in Exhibit C.

The supplemental report is not required to be issued when no instances of noncompliance were found.

REQUEST FOR PROPOSAL (RFP) FOR AUDITING SERVICES AND CONTRACT REQUIREMENTS

Per IC 5-11-1-24 the charter school may not request proposals for performing an examination unless the request for proposals has been submitted to and approved, by the State Board of Accounts. An RFP is needed if the prior auditor is not going to continue providing that service. The RFP and contract negotiations needs to begin well before the end of the fiscal year to be audited to meet the audit completion deadline of 180 days after the close of the audit period discussed above.

Request for proposals must contain the following required wording that the private examiner selected must:

- Be a certified public accountant (CPA) and/or CPA firm licensed to practice in the State of Indiana;

- Meet applicable requirements of the Government Auditing Standards issued by the Comptroller General of the United States (Yellow Book) or the American Institute of Certified Public Accountants (AICPA), if applicable;

- Have no record of performing substandard audits;

- Understand the role of the State Board of Accounts in the audit process and that they are acting as an agent for the State Examiner; and

- Provide their most recent external peer review report; any letter of comment; and any corrective action plan.

The resulting audit contract must also be submitted to the State Board of Accounts for approval. All contracts must reference and include as an attachment State Examiner Directive 2015-2 (Directive) as amended. This Directive serves to notify both parties to the contract that the entire audit process is governed by state statute and uniform compliance guidelines established by the State Board of Accounts. This Directive can be downloaded from our website (www.in.gov/sboa). These documents should be submitted using the charterschools@sboa.in.gov address.

Auditors must adhere to Government Auditing Standards (GAS) issued by the US Government Accountability Office, Comptroller General of the United States. GAS paragraphs 3.82 and 3.96 state an external peer review performed by reviewers independent of the audit organization should be obtained at least once every 3 years. The scope of such review should be sufficient to provide a reasonable basis for determining whether, for the period under review, the reviewed audit organization’s system of quality control was suitably designed and whether the audit organization is complying with its quality control system in order to provide the audit organization with reasonable assurance of conforming to applicable professional standards. Additionally, paragraph 3.105 of Government Auditing Standards states the auditor should make it’s most recent peer review report publicly available.

State Board of Accounts Guidelines for the Audits of Charter Schools Performed by Private Examiners requires the peer review report be included in the documentation submitted in response to a Request for Proposals for audit services. Auditors should submit peer review reports and all associated documentation such as letter of comment, corrective action plan, etc. as soon as available to charterschools@sboa.in.gov.

- B

ACCOUNTS RECEIVABLE – SCHOOL LUNCH AND TEXTBOOK RENTAL

The charter school must have a written policy concerning a procedure for the writing off of bad debts, uncollectible accounts receivable, or any adjustments to record balances.

Documentation must exist for all efforts made by the charter school to collect amounts owed prior to any write-offs.

Officials or employees authorizing, directing or executing write-offs or adjustments to records which are not documented or warranted may be held personally responsible.

We have not taken exception with a governing board approved policy regarding inactive accounts. The policy should define when an account balance is considered inactive. A policy may allow positive account balances to be receipted back into the Fund (we recommend account balances of $10 or less.) However, keep in mind that if a parent or anyone else comes forward and makes a request (and could document entitlement), then they would be entitled to a refund.

A charter school should have a policy in place that does not allow significant negative account balances to incur. The Charter School Board approved policy could allow nominal negative account balances to be offset against the positive balances in the Fund. However, any material negative balances should be pursued for collection.

AUDIT POSITION ON OFFICIAL BONDS

The State Board of Accounts (SBOA) received numerous questions, concerns, and comments from a variety of sources regarding the changes made to Ind. Code § 5-4-1-18 by Senate Enrolled Act (SEA) 393. In response, the SBOA is issuing the attached Updated Bulletin on SEA 393, which replaces the bulletin issued on July 24, 2015. The attached bulletin addresses or clarifies the following issues:

1. The SBOA will not take audit exception to schedule bonds—by name or position—if the bonds are authorized by ordinance, endorsed to cover faithful performance, and include aggregate coverage sufficient to cover all officers, employees, and contractors required to be bonded.

2. The SBOA will not take audit exception if a political subdivision purchases a crime insurance policy in lieu of a bond if the crime insurance policy is authorized by ordinance, endorsed to cover faithful performance, and includes aggregate coverage sufficient to cover all officers, employees, and contractors required to be bonded.

3. It is the audit position of the SBOA that, for purposes of IC 5-4-1-18(a)(7), a “contractor” is a person or business in a contractual relationship with the political subdivision who has a fiduciary relationship with or performs a fiscal responsibility for the political subdivision, and whose accounts are not otherwise covered by the Federal Deposit Insurance Corporation (FDIC).

…5. Considering materiality and the risk of loss to the governing body of a school corporation, the SBOA will not take audit exception if individuals who receive, process, deposit, disburse, or otherwise have access to public funds in an amount less than $100 per event or duty are not bonded.

...X. Bonds for School Treasurers

A. School Treasurers. School treasurers, deputy treasurers, and “any individual whose official duties include receiving, processing, depositing, disbursing, or otherwise having access to funds that belong to a school corporation or the governing body of a school corporation” must be bonded. IC 20-26-4-5(a).

1. The bond amount is determined by the school corporation’s governing body. IC 20-26-4-5(a).

2. The term of the bond is one year commencing on July 1.

3. The bond may be an individual bond, or a blanket bond if (1) the blanket bond is endorsed “to cover the faithful performance of all employees and individuals acting on behalf of the governing body or the governing body’s school corporation,” and (2) “includes aggregate coverage sufficient to provide coverage amounts specified for each individual required” to be bonded. IC 20-26-4-5(b).

4. The governing body must determine who must be bonded under the statute. The term “official duties” is not defined. It is our position that “official duties” may include duties set forth in a job description, duties that are customary or routinely performed, or duties that are assigned but not frequently performed. For example, cafeteria cashiers, teachers who routinely collect lunch money from students and employees who collect textbook rental fees must be bonded. The statute does not require the individual to be an employee of the school corporation. So, for example, parents volunteering in the school lunchroom or at an extracurricular sporting event must be bonded if their official volunteer duties include receiving public funds such as lunch money or admission fees.

5. There is no dollar threshold or de minimis exception in the statute. However, considering materiality and the risk of loss to the governing body, the SBOA will not take audit exception if individuals who receive, process, deposit, disburse, or otherwise have access to public funds in an amount less than $100 per event or duty are not bonded.

6. We recommend that all bonds be filed with and kept by the trustee or board of school trustees. Copies of the bonds must also be submitted to the State Board of Accounts electronically via Gateway with the school’s Annual Financial Report.

B. Extracurricular Treasurers. Extracurricular account treasurers must be bonded if they handle funds in excess of $300 during the school year. IC 20-41-1-6(a).

1. The bond amount is determined by the superintendent and principal of the school approximating the total “anticipated funds that will come into the possession of the treasurer at any one time during the regular school year.” IC 20-41-1-6(a). If school lunch or textbook rental fees are handled by an extracurricular treasurer, then the governing body must set the amount of the bond “sufficient to protect the account for all funds coming into the hands of the treasurer of the account.” IC 20-41-2-6(b).

2. The term of the bond is not specified, but an extracurricular treasurer must be designated “immediately upon the opening of the school term….” Thus, we recommend an annual bond commencing on July 1.

3. The bond may be an individual bond or a blanket position bond for all extracurricular account treasurers. IC 20-41-1-6(b).

4. The bond must be filed with the trustee or board of school trustees. IC 20-41-1- 6(a). A copy of the bond must also be submitted to the State Board of Accounts electronically via Gateway with the school’s Annual Financial Report.

All Bonding Situations

We have noted situations where various employees (other than bonded treasurers and deputy treasurers) are involved in handling cash and cash related transactions (i.e., textbook rental collections, school lunch, etc.) without the school corporation being afforded bond coverage.

We strongly recommend and encourage school officials to immediately obtain bond coverage for all employees that might be handling cash and related transactions. School corporation officials should also give consideration to providing supplemental crime insurance coverage.

Whenever deemed necessary to bond any other employee of a school corporation, the governing body may bond or cause to be bonded such employee or employees by either individual or blanket bonds conditioned upon faithful performance of duties, and in amounts and with surety approved by the school board. A blanket bond should not include any officer, deputy or employee for whom an individual bond is required by statute. Individual bonds are required for the school corporation treasurer and the deputy treasurer.

The official bonds of treasurers, corporation or extra-curricular, must be written for a period of one (1) year, the term of office of the respective treasurer. Bonds may be for a shorter period for a person appointed to complete the term of a treasurer who resigned or is deceased. The bonds shall be payable to the State of Indiana as required by IC 5-4-1-10; and, after approval, shall be filed and recorded in the office of the recorder of the county wherein the treasurer resides as provided in IC 5-4-1-5.1 as well as with Board of School Trustees. No charge shall be made by the recorder of the county for recording the official bonds of any public officer, deputy, appointee or employee (IC 36-2-7-10).

When a minimum premium is required for official bonds, school corporation officials should make certain maximum coverage is provided for the required minimum premium. The State Board of Accounts is of the audit position a new bond should be obtained each year and continuation certificates or renewals should not be used in lieu of obtaining a new bond.

- C

Capital Assets Establishing the Estimated Cost

Conflict of Interest Disclosures

ESTABLISHING THE ESTIMATED COST OF CAPITAL ASSETS

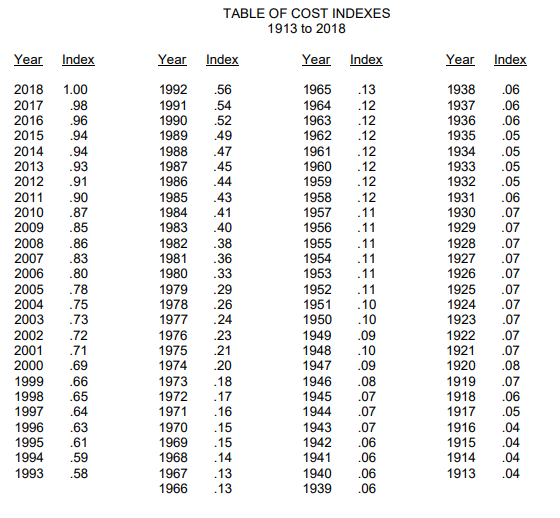

When it is not possible to determine the historical cos of capital assets owned by a governmental unit, the following procedure should be followed.

Develop and inventory of all capital assets which are significant for which records of the historical costs are not available.

Obtain an estimate of the replacement costs of these assets. Through inquiry determine the year or approximate year of acquisition. Then multiply the estimated replacement cost by the factor for the year of acquisitions from the Table of Cost Indexes. The resulting amount will be the estimated cost of the asset.

In some cases estimated replacement cost can be obtained from insurance policies; however, if estimated replacement costs are not available from insurance policies, you should obtain or make an estimate of the replacement costs.

If the replacement cost is estimated to be $76,000.00 and the asset was constructed about 1946, then the estimated cost of the asset should be reported as $6,080.00.

$76,000.00 X .08 = $6,080.00

MONTHLY BANK STATEMENTS AND CANCELED CHECKS

The treasurer of the school corporation should receive a monthly statement at the close of each month from each designated depository which should include all checks paid through the bank and canceled during the period covered by the statement. IC 5-13-6-1 provides in part, “(e) All local investment officers shall reconcile at least monthly the balance of public funds, as disclosed by the records of the local officers, with the balance statements provided by the respective depositories."

The State Board of Accounts’ audit position is that all canceled checks should be retained in the file with the bank statement with which they were returned which will facilitate any future reference of one to the other that may be necessary for either accounting or audit purposes.

IC 5-15-6-3(a) concerning optical imaging of checks states, in part:

“. . . 'original records' includes the optical image of a check or deposit document when:

- the check or deposit document is recorded, copied, or reproduced by an optical imaging process . . . ; and

- the drawer of the check receives an optical image of the check after the check is processed for payment . . ."

Furthermore, IC 26-2-8-111 states, in part: (a) "If a law requires that certain records be retained, that requirement is met by retaining an electronic record of the information in the record that:

- accurately reflects the information set forth in the record after it was first generated in its final form as an electronic record or otherwise; and

- remains accessible for later reference."

(e) "If a law requires retention of a check, that requirement is satisfied by retention of an electronic record of the information on the front and back of the check in accordance with subsection (a).”

CONFLICT OF INTEREST DISCLOSURES

Pursuant to IC 35-44.1-1-4 and for those situations in which they are required, Conflict of Interest Disclosure statements can now be filed with the Indiana State Board of Accounts through the Gateway system. Schools can obtain PDF forms of the disclosures and meet the filing requirements by going to https://gateway.ifionline.org/sboa_coi/.

One of the steps in a regular examination of the financial records and accounts of a charter school by the State Board of Accounts is a review of the various contracts entered into by the governing body of the charter school for the charter school's benefit. The review of construction contracts, construction manager contracts, lease-rental agreements, personnel contracts, transportation contracts, etc. discloses, in some instances, clauses and instances where these contract provisions result in the charter school's making payments from public funds for unauthorized purposes or for which there is no comparable value received for the charter school.

We would suggest that before a governing body approves or signs a contract for any purpose, whether major or minor in nature, the members review the contract very closely for such flaws. An advisable procedure for the governing body, and often financially beneficial to the charter school, is to have persons experienced in such contractual functions review the contract before board approval. Naturally, the attorney for the charter school should review the contract for legality as well as content before the contract is approved and signed by the board.

It is State Board of Accounts policy that the corrective action plan that is required by 2 CFR § 200.511(c) be included in the report that is accepted and placed on our website for public inspection. This separate document is prepared by the auditee and addresses each audit finding in the current audit report that is performed under Uniform Guidance.

- D

Draft and Final Audit Documentation

DRAFT AND FINAL AUDIT DOCUMENTATION SUBMITTED TO STATE BOARD OF ACCOUNTS

Draft and final financial audit reports and supplemental reports provided to the State Board of Accounts for review are to be unsecured/unlocked PDF files. We are unable to process secured files. We are also unable to process draft reports that are incomplete. All auditor opinions and reports must be included in the draft reports for review.

Any written correspondence provided to the charter school from the auditor, frequently referred to as the SAS 114 letter, is also to be provided both in the draft and final form for review. Do not combine the financial audit report, the supplemental report, and the SAS 114 letter into one electronic file. The financial audit report and supplemental report are two separate documents made available on our website for public inspection. The SAS 114 letter is not meant to be publicly available and keeping it as a separate file aids in maintaining its confidentiality.

Also provide a draft of the Data Collection Form for those audits performed under Uniform Guidance for review. Charter schools that receive the established level of federal funding are subject to a single audit also known as Uniform Guidance audits. Remember to add the charterschools@sboa.in.gov email address to the Data Collection Form.

These documents should be submitted using the charterschools@sboa.in.gov address.

- E

Electronic Funds Transfer of State Distributions

ELECTRONIC FUNDS TRANSFER OF STATE DISTRIBUTIONS

IC 4-8.1-2-7 provides that State distributions may be received via Electronic Funds Transfer (EFT). The following reviews the guidelines and procedure for distributions that can be acquired.

IC 5-13-5-5 and IC 20-26-4-1(e) provide that when the governing body authorizes a treasurer to transact the school corporation business with a financial institution via EFT a resolution must be adopted. The resolution must specify the type of transactions to be conducted by EFT and require that adequate documentation of the transaction(s) is maintained.

The following procedures must be followed if your school corporation receives EFTs from the State.

- Determine which distributions you wish to have electronically transferred.

- School Board must adopt a resolution authorizing the EFT. Each distribution to be electronically transferred should be stated in the resolution.

- Select a designated depository or depositories to handle your transactions.

- Execute the Automated Direct Deposit Authorization Agreement, State Form 47551 (copy attached). An Authorization form is needed for each distribution requested electronically.

- Record the transaction in applicable receipt accounts.

- F

Federal Reporting Package - Corrective Action Plan

Forms

Approval of Accounting Forms and Systems

FEDERAL REPORTING PACKAGE CORRECTIVE ACTION PLAN

It is State Board of Accounts policy that the Corrective Action Plan that is part of the Uniform Guidance reporting package (2 CFR §200.512(c)) be a part of the issued financial statement audit report. The Corrective Action Plan is to address each audit finding in the current audit report and should be on the charter school’s letterhead to eliminate any perception that this is a part of the auditor’s finding.

2 CFR §200.511(c) details the information that the Corrective Action Plan must provide as follows:

- name(s) of the contact person(s) responsible for corrective action;

- the corrective action planned; and

- the anticipated completion date.

APPROVAL OF ACCOUNTING FORMS AND SYSTEMS

The State Board of Accounts is charged by law with the responsibility of prescribing and installing a system of accounting and reporting which shall be uniform for every public office and every public account of the same class and contain written standards that an entity that is subject to audit must observe. The system must exhibit true accounts and detailed statements of funds collected, received, obligated and expended for or on account of the public for any and every purpose. It must show the receipt, use and disposition of all public property and the income, if any, derived from the property. It must show all sources of public income and the amounts due and received form each source. Finally it must show all receipts, vouchers, contracts, obligations, and other documents kept, or that may be required to be kept, to prove the validity of every transaction. [IC 5-11-1-2]

The system of accounting prescribed is made up of the uniform compliance guidelines and the prescribed forms. A prescribed form is one which is put into general use for all offices of the same class.

Computer hardware, software and application systems can now produce exact replicas of the forms prescribed by the State Board of Accounts. An exact replica of a prescribed form is a computerized form that incorporates all of the same information as the manual prescribed form. Prescribed form replication is the preferred approach from the State Board of Accounts’ position. These exact replicas are the equivalent of the prescribed form and require no further action for the school corporation to install the form within their accounting system.

Governments are required by law to use the forms prescribed by this department. However, if it is desirable to use a form other than the prescribed manual form, that is not an exact replica; the new form must be approved by State Board of Accounts.

All forms previously approved by sending copies to State Board of Accounts and receiving a form approval letter are approved with the conditions contained with the letter.

After April 1, 2014, if a government implements, consistent with the provisions of Indiana Code and Uniform Compliance Guidelines, an automated accounting system that is to be considered for approval, the responsible official is not required to maintain the prescribed forms replaced by the automated system while awaiting the approval. New forms must be in place during at least one (1) State Board of Accounts audit and must not be an element of an audit finding or audit result and comment that is responsible or partially responsible for an exception found during an audit to be considered approved. The government is responsible for placing on new forms the year of installation in the upper right corner. This reference should be similar to “Installed in ______________ Charter School , (Year).” The School must maintain and present for audit a log of forms installed after April 1, 2014 with the year installed for all forms that replace forms prescribed by State Board of Accounts.

The government agrees to comply with the following conditions, if applicable, for any new forms installed.

- The forms and system installed are subject to review and/or recommendations during audits of the government to ensure compliance with current statutes and uniform compliance guidelines.

- The government shall continue to maintain all prescribed forms not otherwise covered by an approval.

- All transactions that occur in the accounting system must be recorded and accessible upon proper request. Transactions can be maintained electronically, with proper backups, microfilmed, or printed on hardcopy. These transactions include, but are not limited to, all input transactions, transactions that generate receipts, transactions that generate checks, master file updates, and all transactions that affect the ledgers in any way. The system must be designed so that changes to a transaction file cannot occur without being processed through an application.

- The ability must not exist to change data after it is posted. If an error is discovered after the entry has been posted, then a separate correcting entry must be made. Both the correcting entry and the original entry must be maintained.

- If the government owns the source code, sufficient controls must exist to prevent unauthorized modification. If the government does not own the source code, the vendor shall provide representatives of the State Board of Accounts with access to all computer source codes for the system upon request for audit purposes. In addition, the vendor shall provide representatives of the State Board of Accounts with a document describing the operating system used, the language that the source code is written in, the name of the compiler used, and the structure of the data files including data file names, data file descriptions, field names, and field descriptions for the system.

- Any receipts, checks, purchase orders, or other forms that require numbering shall be either prenumbered by an outside printing supplier or numbered by the government's computer system with sufficient controls installed in the system to prevent unauthorized generation of the form or duplication of numbers.

- All receipts must be either in duplicate or recorded in a prescribed or approved register of receipts.

- All checks must be either in duplicate or recorded in a register of checks generated by the computer.

- Recap sheets for each deposit for deposit advices, if applicable, will be maintained indicating direct deposits. Individual wage assignment agreements will be kept on file to support direct deposit.

- "Installed by __________ Charter School, (Year)" shall be printed, in the upper right corner, on each approved form furnished by a printing supplier and, when practical, on those printed from accounting systems at the unit. Upon the installation of a new form the form will be entered on a log for this purpose with the date of installation; and the name and number of the prescribed form replaced. The log must be available for audit.

- The government officials are responsible to ensure that forms and accounting systems installed comply with the uniform compliance guidelines for information technology services published in the Charter School bulletins and accounting manuals. This includes ensuring that customization of the system done by the vendor for implementation at the government is done in such a manner that the system remains compliant.

- In the event a change is required due to the passage of a State or Federal law, the government agrees to implement the change in a timely manner.

- G

Gateway

Fiscal Agent and Gateway Reporting

Grant Reporting on Gateway - Annual Financial Report

FISCAL AGENT AND GATEWAY REPORTING

IC 20-24-7-1 defines the organizer of the charter school as the fiscal agent. The organizer has exclusive control of funds received by the charter school and its financial matters. The fiscal agent is responsible for submission of the Annual Financial Report via Gateway. Individuals with Gateway “Submission” rights are allowed to enter information and submit the report. Submission rights cannot be delegated. If you do not have a User Account, you can request one by completing the form here https://gateway.ifionline.org/requestaccess.asPX.

Individuals can be provided “Edit” rights. These individuals can enter information but cannot submit the report. Often, these individuals are office staff, consultants, and other third-parties. The fiscal agent must submit a Limited Delegation of Authority (http://www.in.gov/sboa/files/DelegationForm.pdf) form to the State Board of Accounts to establish users with “Edit” rights. If you want to remove a current user from Annual Financial Report, submit a Limited Delegation of Authority form to SBoA and change the user access to “NONE”.

You should not share your User Account with others. Each person that needs access to the Gateway should have their own User Account. Each user will be responsible for any actions taken by someone using their User Account. The fiscal agent is responsible for the accuracy and completeness of the submitted Annual Report regardless of how or who entered the data.

The State Board of Accounts will not take exception to the use of gift cards by a charter school provided the following criteria are observed:

- The Charter School Board must authorize gift card purchases through a resolution, which has been approved in the minutes.

- The purposes for which gift cards may be issued must be specifically stated in the resolution.

- Purchase and issuance of gift cards shall be handled by an official or employee designated by the school principal.

- The designated responsible official or employee shall maintain an accounting system or log which includes the name of the business from which the gift cards were purchased, their amounts, fund and account numbers to be charged, date the card was issued, person gift card was issued to, proof that the gift card was received by the person it was issued to, etc.

- Gift cards shall not be used to bypass the accounting system. One reason that purchase orders are issued is to provide the fiscal officer with the means to encumber and track appropriations to provide the governing board and other officials with timely and accurate accounting information and monitoring of the accounting system.

- Procedures for payments shall be no different than for any other claim. The school principal must approve the expenditure and supporting documents such as paid bills and receipts must be available. Additionally, any purchase or issuance of gift cards without proper documentation maybe the responsibility of that officer or employee.

GRANT REPORTING ON GATEWAY ANNUAL FINANCIAL REPORT

We have received many inquiries about the correct information that needs to be reported in the Grant section of the Gateway Annual Financial Report. The information that you input into this section will be used during your next audit to compile the Schedule of Expenditures of Federal Awards (SEFA). The main question we have gotten is what to include in the receipts and disbursements columns. For most grants you will simply include the actual receipts and disbursements from your records for the period covered. Your selection in the “Grant Type” column will dictate to our SEFA macro which column to pull for inclusion on the SEFA, receipts for reimbursement grants and disbursements for advance grants. For schools there are two exceptions that we know of for the Child Nutrition Cluster grants and the Special Education grants.

Child Nutrition Cluster grant activity is recorded in the School Lunch fund, 800, along with other program transactions. Therefore, you should input into the receipt column only the federal grant reimbursements that you have actually received from July to June. In most cases, it is hard to segregate which expenses are attributable and paid for federal expenses and which expenses are paid or partially paid with local dollars. Therefore, our suggestion is to use a federal in, federal out theory. Meaning that the first money you use to pay for expenses was the federal grant money that you received. So, for the period you would include the same amount in the disbursements column as you did in the receipts column. I would also remind you that many schools participate in the commodities program. So, you would have to obtain an amount that you would input into the “Amount of Federal Noncash Assistance for the Year” column. To get the commodities information you will have to access the School Nutrition portal (scnweb.doe.state.in.us). After you have logged in, you will click the green puzzle piece labeled “Food Distribution Program” and click continue at the bottom of the Welcome page. You select the program year and then you click “Summary Menu” near the top of the next page. Click “R/A Summary” and then search for your school corporation’s name. This will take you to the School Corporation’s page and you will want to go to the “Entitlement” tab. When you get to the entitlement tab you will add the amounts in the following columns “Entitlement Used”, “No Charge Used”, and “Bonus Used”. The sum will be included in the School Lunch Program grant line.

For the schools that participate in a Special Ed Cooperative, we have been made aware of some additional information that will probably change how Special Ed grant funds have been reported in the past. We met with IDOE officials and learned that the grant awards for the past few years have actually been given to member schools and not any Special Ed Co-Ops. Therefore, our opinion is that for a school’s SEFA to be correct, they would have to include the Special Ed grant money on their schedule and not a Co-Op schedule. We have been told that local Co-Op relationships are handled in a number of different ways throughout the state. Here are three basic relationships that we are aware of and how to handle including the Special Ed grants in your grant section.

- Grants are awarded to member schools, a Co-Op is named the fiscal agent, and all grant reimbursements are sent to Co-Op. Schools pay Special Ed program expenses like salaries, and equipment and apply for reimbursement to the Co-Op. The Co-Op reimburses the member school, who records the receipt in a Special Ed fund. Since all the receipts and disbursements are included in the member school’s records, then they would just include those amounts in their grant section.

- Similar to situation #1 where the member school pays expenses and receives reimbursements from the Co-Op, but the Co-Op retains an administrative fee from the grant funds. The Co-Op should allocate how much of the administrative fee retained is attributable to each member school. The allocation could be based on the local agreement, percentage of total grant awards for the member schools, percentage of students served for each member school, etc. As long as there is a reasonable basis for the allocation, IDOE has indicated they do not have an issue. For the grant section, each member school would have to add the reimbursements they received to their allocation of the administrative fee the Co-Op provided.

- In this situation grants are awarded to member schools, a Co-Op is named the fiscal agent, and all the grant reimbursements are sent to the Co-Op. The difference is that the Co-Op pools all the money and pays for the expenses of the Special Ed programs. Because both receipts and disbursements are running through the Co-Op, the member schools do not show any Special Ed transactions in their records. So, the Co-Op with have to do a similar allocation as mentioned in #2, but it will have to be based on all the grant reimbursements and expenses for the period. They should provide the member schools with their total allocation and that is what each member school should include in the grant section of their Gateway AFR.

- H

- I

Internal Controls

Acceptable Minimum Level of Internal Controls

ACCEPTABLE MINIMUM LEVEL OF INTERNAL CONTROL STANDARDS AND PROCEDURES

Indiana Code 5-11-1-27 requires the State Board of Accounts (SBOA) include an acceptable minimum level of internal control standards and procedures in their Compliance Guidelines Manuals. Subsection (g) requires the Charter School Board adopt the minimum level of internal control standards and ensure that “personnel” have been trained on those minimum standards. The minimum level of internal control standards can be found in the SBOA’s Uniform Internal Control Standards for Indiana Political Subdivisions manual (http://www.in.gov/sboa/files/UniformInternalControlStandards.pdf). The statute defines “personnel” as, “an officer or employee of a political subdivision whose official duties include receiving, processing, depositing, disbursing, or otherwise having access to funds that belong to the federal government, state government, a political subdivision, or another governmental entity.” The SBOA has included the various “approved” training materials in the Internal Control section of its website (http://www.in.gov/sboa/5072.htm).

Indiana Code 5-11-1-27(h) requires that after June 30, 2016, the fiscal officer of a Charter School must certify that the minimum internal control standards have been adopted and the “personnel” have been trained. The certification by the fiscal officer is made on the Gateway Annual Financial Report by answering the question listed in the “Unit Questions” section. Subsection (i) requires that for audits performed after June 30, 2016, if the SBOA, or its designees, find a political subdivision that has not adopted the minimum internal controls standards or has personnel that has not received training, then a comment will be included in the examination report for that political subdivision.

ADOPTION OF INTERNAL CONTROL STANDARDS

Indiana Code 5-11-1-27 requires the state board of accounts define the acceptable minimum level of internal control standards for political subdivision. As a result, we have completed a manual entitled “Uniform Internal Control Standards for Indiana Political Subdivisions”. The manual and the approved training materials were presented and approved by the Legislative Audit Committee. We have posted the manual to the SBOA website on a newly created page under Political Subdivisions called “Internal Control Standards” (http://www.in.gov/sboa/5072.htm). This page has a link to the manual itself and lists the approved training and the certification requirements. It also references other sources of information on internal controls. We have added the same information to each political subdivisions page on the SBOA website. Finally, you can we placed a link to the manual on the SBOA homepage under our mission statement.

Part One of the manual lists the minimum standards which include the five components of internal control and the seventeen principles. Part Two of the manual is called Approved Personnel Training Materials and also contains examples and case studies, which are not part of the minimum level of standards but do provide additional information and examples that can be used in the implementation of internal controls by the subdivision. There is a certification form for internal control training in the appendix to the manual.

We have completed a webinar that will be posted on the SBOA website this month which will provide additional training information that can be used by the political subdivision. In the past few months we have used the information during presentations at meetings we have attended. The webinar will make the information available to all employees of the subdivision. During the training we have done to date at various meetings, we have tried to be very clear that in order to retain our independence to audit political subdivisions; Generally Accepted Government Auditing Standards (the "Yellow Book") prohibits the SBOA from prescribing the actual internal control procedures to be used by a political subdivision.

By statute, after June 30, 2016, the legislative body must ensure that internal control standards are procedures are adopted and that the appropriate personnel receive training on internal controls and procedures. The fiscal officer will file a certification along with subsequent Gateway annual reports.

INNOVATION NETWORK SCHOOLS AND INNOVATION NETWORK CHARTER SCHOOLS – COMPLIANCE TESTING DURING THE AUDIT

We have not currently prescribed additional compliance testing to be performed on an Innovation Network school that is part of a public school corporation audited by the SBoA (such as Indianapolis Public Schools). The audit performed of the entity contracted by a public school corporation to manage an Innovation Network school should be performed in accordance with the needs of the entity and to satisfy the terms of the contract between the entity and the public school corporation.

However, there is additional compliance testing required of Innovation Network Charter Schools. Independent public accountants performing these audits are required to perform the testing laid out in the ‘Guidelines for the Audits of Charter Schools Performed by Private Examiners’ for Innovation Network Charter Schools.

- J

- K

- L

- M

Mileage Rates - State and Federal

Minimum Wage and Overtime Provisions

STATE AND FEDERAL MILEAGE RATES

The State mileage rate is set by the Indiana Department of Administration. You can view the current mileage rate at their website.

Please note that different federal grants may impose additional restrictions.

MINUMUM WAGE AND OVERTME PROVISIONS

Your attorney should be consulted concerning the federal minimum wage and overtime provisions of the Fair Labor Standards Act applicable to school corporations. The Act generally exempts professionals from coverage and teachers are expressly included in that category with certain exceptions. However, office personnel, maintenance workers, cafeteria workers, bus drivers and others have been included.

The overtime pay issue has required the State Board of Accounts to prescribe form 99c, Employee’s Weekly (work period) Earnings Record (Form 99c) which is designed to meet the record keeping requirements of the minimum wage and overtime provisions of the Fair Labor Standards Act (FLSA). The form should be maintained for employees who are not exempt from FLSA and who are not on a fixed work schedule when the governmental unit pays other than weekly.

School corporations should constantly be aware of all of the areas of employment in the school corporation where overtime right attaches and establish a system to accurately record hours worked.

- N

- O

- P

Purchases through State Contracts

During our recent run of school training presentations, we have included our opinion on the proper treatment of student meal deposits. Our opinion is that money a student puts into their individual meal account should not be considered income to the child nutrition program until that student goes through the lunch line and charges a meal to their account. Therefore, while it is in the student’s individual account the balance should not be included in Fund 800 School Lunch. Our recommendation is that you set up a clearing account with the fund number of 8400. Our suggestion is when a student brings in a deposit the receipt would be recorded to fund 8400 using receipt account number 1630. Periodically, after the student has charged meals, you should disburse the amount charged from 8400 using expenditure account 31900 and receipt it into fund 800 using receipt accounts 1611-1623. At this point it is considered program income and should be included on any reports that are required to be completed. Also, on a monthly basis the balance of the 8400 fund should be reconciled with the total of the individual meal accounts. We will update the chart of accounts to reflect these suggestions when the School Manual is updated.

Along with recording student meal deposits properly, we have been discussing the need of the school board to set a policy that would dictate how situations are treated when it comes to student meal accounts. The school board should adopt a policy if they want to allow accounts to be able to accrue negative balances, to be written off at any point, what the process is for collecting balances owed, etc. We will audit to the policy set by the school board

We have received inquiries concerning the potential use of "procurement cards". We understand some of the intended benefits of procurement cards are to add controls as to where purchases can be made; limit values of each purchase; prevent overspending the budget items; institute parameters on purchases; possibly reducing paperwork; etc.

The State Board of Accounts will not take exception to the use of procurement cards by a governmental unit provided the following criteria are observed:

- The governing board must authorize procurement card use through an ordinance or resolution, which has been approved in the minutes.

- Issuance and use should be handled by an official or employee designated by the board.

- The purposes for which the procurement card may be used must be specifically state in the ordinance or resolution.

- When the purpose for which the procurement card has been issued has been accomplished, the card should be returned to the custody of the responsible person.

- The designated responsible official or employee should maintain an accounting system or log which would include the names of individuals requesting usage of the cards, their position, estimated amounts to be charged, fund and account numbers to be charged, date the card is issued and returned, etc.

- Procurement cards should be used in conjunction with the accounting system.

- Payment should not be made on the basis of a statement or a procurement card slip only. Procedures for payments should be no different than for any other claim. Supporting documents such as paid bills and receipts must be available. Additionally, any interest or penalty incurred due to late filing or furnishing of documentation by an officer or employee should be the responsibility of that officer or employee.

- If properly authorized, an annual fee may be paid.

- Procurement cards shall not be used to procure cash advances at "ATM" machines or as a debit card.

- (A) An audit trail must exist for all transactions. (B) An audit trail must also exist for changes made by an "administrator" such as card parameters, etc..

- Access to transactions in accordance with the Public Records Law, IC 5-14-3-1 et seq. as appropriate must be assured.

- Procurement card agreements should not contain references to debt.

- Governmental units need to have available (if applicable) a copy of "SAS 70" audits of a sponsoring bank.

Indiana Code 20-24-4-1 requires a Charter School’s charter to specify that the records of the charter school are subject to the Access to Public Records Law, IC 5-14-3.

The official policy of the State is: "all persons are entitled to full and complete information regarding the affairs of government and the official acts of those who represent them as public officials and employees. Providing persons with the information is an essential function of a representative government and an integral part of the routine duties of public officials and employees, whose duty it is to provide the information."

For more information you should review IC 5-14-3, Chapter 9 of the Accounting and Uniform Compliance Guidelines Manual for Indiana Charter Schools, and the Public Access Counselor’s webpage (www.in.gov/pac).

PURCHASES WITH SUPPLIERS THROUGH STATE CONTRACTS AND WITHOUT GIVING NOTICE OR RECEIVING BIDS

We often receive inquiries regarding how a school corporation can purchase supplies utilizing a State contract.

IC 4-13-1-1(c) states in part, “. . . the following entities may, with the consent of the commissioner of the department of administration, use the services of the department:… (4) A political subdivision, as defined in IC 36- 1-2-13."

IC 5-22-10-15(b) states, "A purchasing agent for a political subdivision may purchase supplies if the purchase is made from a person who has a contract with a state agency and the person's contract with the state requires the person to make the supplies or services available to political subdivisions, as provided in IC 4-13-1.6 or IC 5-22-17-9." IC 5-22-17-9 states, "A contract entered into by a state agency may require the contractor to offer to political subdivisions the services or supplies that are the subject of the contract under conditions specified in the contract."

Please call the Department of Administration at (317)-232-3901 or visit the website at www.in.gov/idoa/proc for more information.

- Q

- R

Retiring Employees - PERF/TRF Contracts

The federal Fair Labor Standards Act (FLSA) requires that records of wages paid, daily and weekly hours of work, and the time of day and day of week on which the employee's work week begins be kept for all employees. These requirements can be met by use of the following prescribed general forms:

- General Form 99 A, Employees' Service Record

- General Form 99B, Employee's Earnings Record

- General Form 99C, Employee's Weekly Earnings Record

General Form 99C is required only for employees who are not exempt from FLSA, are not on a fixed work schedule, and are not paid weekly.

Additional information regarding FLSA rules and regulations may be obtained from the Department of Labor.

CONTRACTS FOR RETIRING EMPLOYEES INCLUDED IN PERF AND TRF

IC 5-10.2-4-3 concerns the average of the annual compensation and states in part: “(a) Except as provided in subsection (f), in computing the retirement benefit for a nonteacher member, ‘average of the annual compensation’ means the average annual compensation calculated using the twenty (20) calendar quarters of service in a position covered by the retirement fund before retirement in which the member's annual compensation was the highest. However, in order for a quarter to be included in the twenty (20) calendar quarters, the nonteacher member must have performed service throughout the calendar quarter. All twenty (20) calendar quarters do not have to be continuous but they must be in groups of four (4) consecutive calendar quarters. The same calendar quarter may not be included in two (2) different groups. (b) This subsection does not apply to a teacher member described in subsection (c). In computing the retirement benefit for a teacher member, ‘average of the annual compensation’ means the average annual compensation for the five (5) years of service before retirement in which the member's annual compensation was highest. In order for a year to be included in the five (5) years, the teacher member must have received for the year credit under IC 5-10.4-4-2 for at least one-half (1/2) year of service. The five (5) years do not have to be continuous” …”(d) Subject to IC 5-10.2-2-1.5, ‘annual compensation’ means: (1) the basic salary earned by and paid to the member plus the amount that would have been part of that salary but for: (A) the state's, a school corporation's, a participating political subdivision's, or a state educational institution's paying the member's contribution to the fund for the member; or (B) the member's salary reduction agreement established under Section 125, 403(b), or 457 of the Internal Revenue Code; and (2) in the case of a member described in subsection (c) and for years of service to which IC 5-10.4-5-7 does not apply, the basic salary that was not paid during the year but would have been paid to the member during the year under the member's employment contracts, if the member had not taken any unpaid leave of absence to serve in an elected position. The portion of a back pay award or a similar award that the board determines is compensation under an agreement or under a judicial or an administrative proceeding shall be allocated by the board among the years the member earned or should have earned the compensation. Only that portion of the award allocated to the year the award is made is considered to have been earned during the year the award was made. Interest on an award is not considered annual compensation for any year. (e) Compensation of not more than two thousand dollars ($2,000) received from the employer in contemplation of the member's retirement, including severance pay, termination pay, retirement bonus, or commutation of unused sick leave or personal leave, may be included in the total annual compensation from which the average of the annual compensation is determined, if it is received: (1) before the member ceases service; or (2) within twelve (12) months after the member ceases service.”

We are of the audit position for the benefit of those teachers who are retiring as of the close of school year, that all compensation for service rendered on teaching contracts should be completed by the close of the school year (June 30) so that full reporting may be made of both compensation and service for that teacher at the close of the school year following which the retirement is to become effective.

- S

Please visit the Department of Revenue site at http://www.in.gov/dor/3650.htm for information pertaining to numerous items of interest to charter schools, including, but not limited to Sales Tax Bulletins 4 and 32. Any questions concerning the information included therein should be directed to the Department of Revenue.

OMB CIRCULAR A-133 REQUIREMENTS

The Single Audit Act and the Office of Management and Budget (OMB) Circular A-133 set out the responsibilities of entities receiving federal awards. Subrecipient monitoring is required by the governmental entity receiving the federal funds which are passed through to governmental and nongovernmental subrecipients.

We recommend that the charter school organizer have a formal subrecipient monitoring plan, in written form, for all federal programs which pass federal monies through to subrecipients. The monitoring plan should identify the procedures the charter school organizer has in place to monitor the activities of the subrecipient to ensure that the program requirements are being met. Such monitoring plans should include for instance, formal procedures to request subrecipients to provide written documentation supporting requests for reimbursements and the procedure the charter school organizer will use to review such documentation, the nature, timing, and extent of on-site visits, etc., and should also:

- Identify federal awards made by informing each subrecipient of CFDA title and number, award name and number, award year, if the award is R & D and the name of federal agency. When some of this information is not available, the pass-through entity shall provide the best information available to describe the Federal award.

- Advise subrecipients of requirements imposed on them by federal laws, regulations, and the provisions of contracts or grant agreements as well as any supplemental requirements imposed by the pass-through entity.

- Monitor the activities of subrecipients as necessary to ensure that federal awards are used for authorized purposes in compliance with laws, regulations, and the provisions of contracts or grant agreements and that performance goals are achieved.

- Ensure that subrecipients expending $500,000 or more in federal awards during the subrecipient's fiscal year have met the audit requirements for that fiscal year.

- Issue a management decision on audit findings within six months after receipt of the subrecipient's audit report and ensure that the subrecipient takes appropriate and timely corrective action.

- Consider whether subrecipient audits necessitate adjustment of the pass-through entity's own records.

- Require each subrecipient to permit the pass-through entity and auditors to have access to the records and financial statements as necessary for the pass-through entity to comply with the Circular.

- T

Trips by Employees and Pay for Services

Title I and Title II - Administrative Expenses

Currently, the prescribed method for the documentation of transfers between funds in the Uniform Compliance Manuals states that a warrant should be issued, charged to the original fund, payable to the unit and the amount should be receipted into the new fund to provide an adequate audit trail for these transfers. These procedures were developed for manual record keeping and are still prescribed for all manual ledgers and tracking. However, we realize many accounting software programs are available that allows a transfer between funds that may also provide an adequate audit trail for the transfer. We have taken a new audit position that we will not take exception to an electronic transfer on the ledger if there is an adequate audit trail to support the transfer transaction. If a unit prefers to use a ‘paper check’ to document transfers, we would also not take audit exception. In either case, the unit needs to have sufficient internal controls over the transactions to provide accuracy. The unit should be able to provide a report of all transfers during the year from each issuing fund to the receiving fund and document that transfers in equal transfers out. It is important that the method for documenting transfers be applied consistently to provide an accurate report on transfers.

The following sets forth the audit position of the State Board of Accounts with regard to reimbursements made by charter schools to their employees for travel and meal expenses.

A charter school may reimburse such persons for actual miles traveled in their own motor vehicles on the official business of the charter school at a reasonable rate per mile as fixed by a resolution of the charter school board. The mileage rate should be fixed by the board having authority to approve claims for travel expenses. No particular mileage rate has been set by the State of Indiana for all local units of government and, consequently, the mileage rate lies within the discretion of the charter school board, unless otherwise provided by statute. The body setting the mileage rate should also determine whether parking fees and toll charges are included in the rate or, on the other hand, whether such expenses are to be reimbursed separately based on the submission of receipts.

Reimbursed mileage should not include travel to and from the employee's home and regular place of employment. If more than one person rides in the same vehicle, only one mileage reimbursement is allowable. General Form 101 (or an approved substitute) should be used for claiming mileage. The odometer reading columns on this form are to be used only when the distance between points cannot be determined by fixed mileage or official highway maps.

When traveling outside the charter school’s boundaries on official business, employees may also be reimbursed for meals, lodging, and incidental expenses as defined in the travel policy. The claim for reimbursement should be supported by itemized receipts from hotels, restaurants, and taxi cabs used by the employee while traveling on official business.

It is permissible for the charter school board having the authority to approve claims to adopt a resolution establishing a reasonable per diem rate intended to cover travel expenses other than hotel and mileage costs and the employee may be reimbursed on the basis of such a per diem rate in lieu of submitting receipts. If a fixed per diem rate is established by policy, the policy should clearly indicate which type of expenses, in addition to meals, are included in the rate and which expenses are to be reimbursed on the basis of actual receipts being submitted by the employee.

The policy should also define the charter school’s boundaries for purposes of reimbursing travel; i.e., outside a 50- mile radius of the school, outside of the county, etc. The policy should cover a proportionate reduction in the per diem rate when meals are provided by an outside party.

When state statutes govern the amounts of allowable travel reimbursements, those statutes supersede local policy. Also, when determining the reasonableness of a mileage rate or per diem rate, consideration should be given to rates established by the State of Indiana and the Federal government. The charter school should, however, consider the income tax implications of setting its rates higher than the current Federal rates.

In all cases, an employee requesting reimbursement for overnight travel is required to submit a receipt from the hotel or other meeting place where such accommodations were provided.

TRIPS BY EMPLOYEES AND PAY FOR SERVICES