Inheritance Tax Records

There are two types of tax records kept at the Indiana State Archives. Genealogists may be interested in the tax records as a source of information about relatives. These tax records were created by the inheritance tax law of 1913. County circuit courts were responsible for deciding the fair market value of inheritance properties and that amount was then paid to the county treasurer who submitted the funds along with a report to the auditor of state. The law was supervised by the State Board of Tax Commissioners and an inheritance tax investigator. Today, the Indiana Department of Revenue is responsible for inheritance taxes.

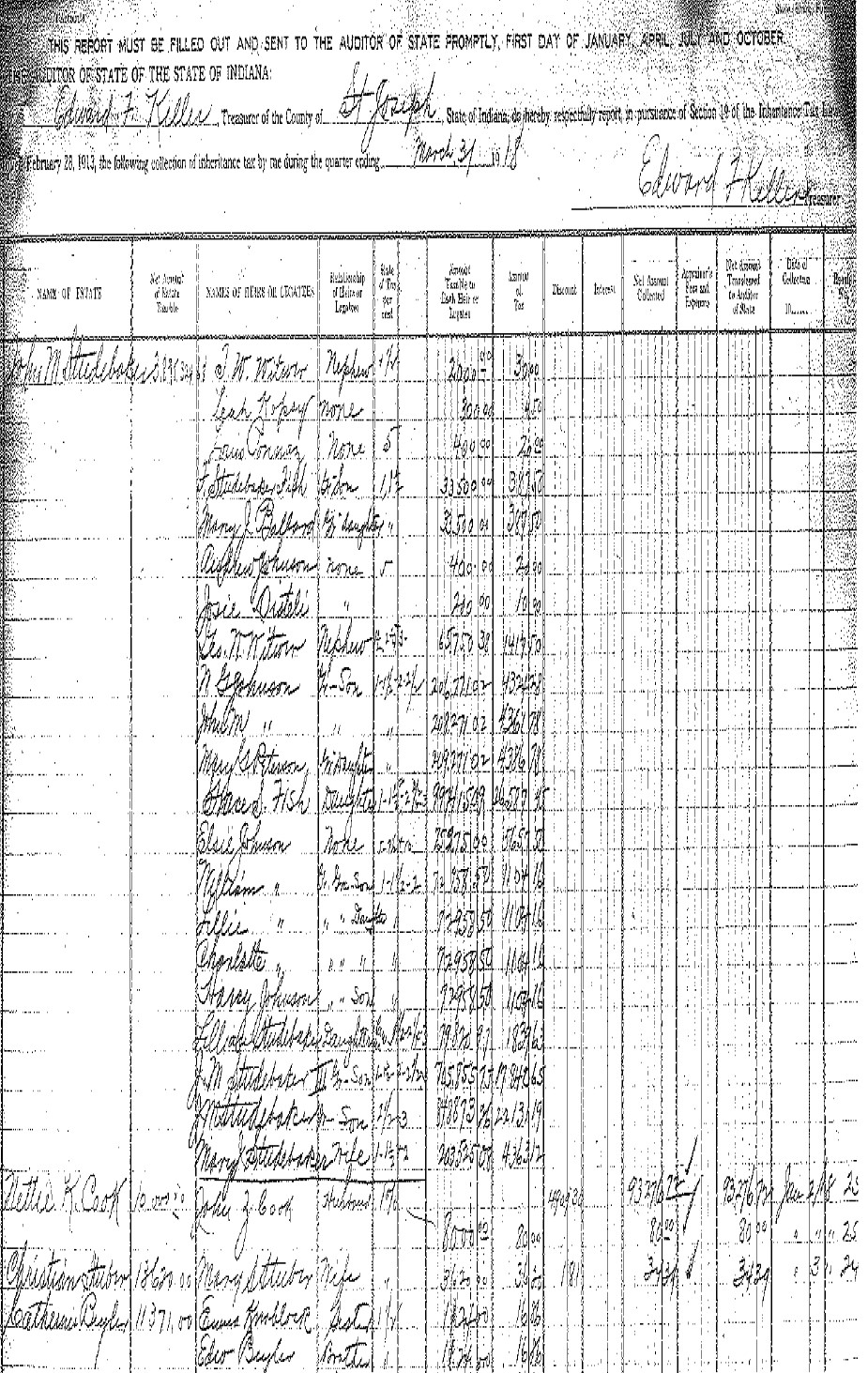

The first collection of inheritance tax records at the Indiana State Archives is the original quarterly county treasurers’ reports from the Auditor of State from the years 1913 to 1933. Early reports contain information including case number, name of estate (name of the deceased, net amount of estate taxable, name(s) of heirs, relationships of heirs to the deceased, amount taxable to each heir, amount of tax, discount (not always applicable), interest (if any), net amount collected, appraiser’s fees and expenses, net amount transferred to state auditor, date of collection by treasurer, and receipt number. In 1925, the forms were shortened and only include the case number, name of estate/deceased, date of collection, receipt number, name(s) of heirs for whom paid, total amount of tax imposed, discount, interest, and net amount collected.

While the reports for Marion through Whitley counties are complete, the reports for Adams through Madison counties were missing when the collection came to the Archives. These missing county reports have not been found.

The second collection of inheritance tax records comes from the Indiana Department of Revenue. There are 259 boxes of “Index Cards to Inheritance Tax Schedules, May 1, 1913-1968.” These boxes are 3x5 cards and come from all 92 Indiana counties. There are approximately 275,000 index cards in the collection. They are arranged alphabetically by the decedent’s name within each county. The cards include the name of the deceased, the county, the date of the order, case number, tax, discount of interest, and the tax paid. Many cards also include the death date and whether real estate was involved. This is a useful resource to genealogist when looking for death dates of little-known relatives.

For questions or to schedule an appointment to view the inheritance tax records contact IARA at arc@iara.in.gov or call 317-591-5222.

Adapted from Barbra F. Wood’s “Inheritance Taxes: Indiana’s Inheritance Tax Records at the Indiana State Archives,” Connections, 2007, vol 27, issue 2, pp.124-127.